Commit Error. Quickbooks Payroll For Mac

Question: How do I correct error message 'Out of Balance' when posting my payroll? Answer: The payroll program exports your payroll in what is referred to as a Balanced Transaction file, meaning that the total Debits, or all items that are expenses, equals the total Credits, or all items that are liabilities plus Net Pay. An Out of Balance error indicates that you either you have:. An item linked as a Debit/Credit and needs to be switched;.

An item not linked to an account in Quickbooks or;. An item has too many links.

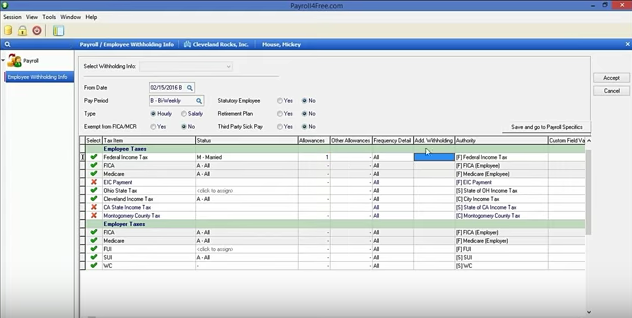

Resolve the Error:. First check your Link Report. Click 'Done' to return to the main Payroll Navigator screen and click on 'Quickbooks Links' in the lower right. Click on the arrow to the left of Designate Account Links to expand the window. Click on the 'Report' button in the lower right to pull up your Link Report. At the bottom of the list, look under the Missing Items Deductions and Missing Items Employer Paidbelow the list in the window. Any Deductions not linked and any Employer Paid Items without the required 2 links will be listed.

They would need to be linked for payroll to properly post. If they both say 'Nothing Missing' then look at the list and make sure that items are linked properly. Items marked Income (I)are income items that make up Gross Pay. Required Link:. Linked as a Debit to an 'Expense Account'. If all Gross Pay items will be posting to the same account you just need to link Gross Pay (Not Assigned or All). FAQ: When posting my liability payments, I receive a message 'No Records were exported.'

How do I correct this? FAQ: How do I correct the error, 'Forms Engine Failure' on OS Sierra? FAQ: How do I correct the error, 'Company Information is invalid.' When processing Print & Mail reports? FAQ: How do I correct the error, 'The application may be damaged when opening after installing program on new computer.' FAQ: How do I correct the error, 'Your Tax Table Registration Code is expired or invalid' after entering new code?

Question: How do I correct error message 'Out of Balance' when posting my payroll? Answer: The payroll program exports your payroll in what is referred to as a Balanced Transaction file, meaning that the total Debits, or all items that are expenses, equals the total Credits, or all items that are liabilities plus Net Pay. An Out of Balance error indicates that you either you have:. An item linked as a Debit/Credit and needs to be switched;. An item not linked to an account in Quickbooks or;.

An item has too many links. Resolve the Error:.

First check your Link Report. Click 'Done' to return to the main Payroll Navigator screen and click on 'Quickbooks Links' in the lower right.

Click on the arrow to the left of Designate Account Links to expand the window. Click on the 'Report' button in the lower right to pull up your Link Report. At the bottom of the list, look under the Missing Items Deductions and Missing Items Employer Paidbelow the list in the window. Any Deductions not linked and any Employer Paid Items without the required 2 links will be listed. They would need to be linked for payroll to properly post.

If they both say 'Nothing Missing' then look at the list and make sure that items are linked properly. Items marked Income (I)are income items that make up Gross Pay. Required Link:.

Linked as a Debit to an 'Expense Account'. If all Gross Pay items will be posting to the same account you just need to link Gross Pay (Not Assigned or All).

FAQ: When posting my liability payments, I receive a message 'No Records were exported.' How do I correct this? FAQ: How do I correct the error, 'Forms Engine Failure' on OS Sierra?

Commit Error. Quickbooks Payroll For Mac Free

FAQ: How do I correct the error, 'Company Information is invalid.' When processing Print & Mail reports?

FAQ: How do I correct the error, 'The application may be damaged when opening after installing program on new computer.' FAQ: How do I correct the error, 'Your Tax Table Registration Code is expired or invalid' after entering new code?